Another year is almost in the books, which means now is a good time to make sure your financial situation is in order prior to ringing in the New Year. Sifting through the numerous financial deadlines and planning opportunities coupled with the busy holiday season can be a bit stressful.

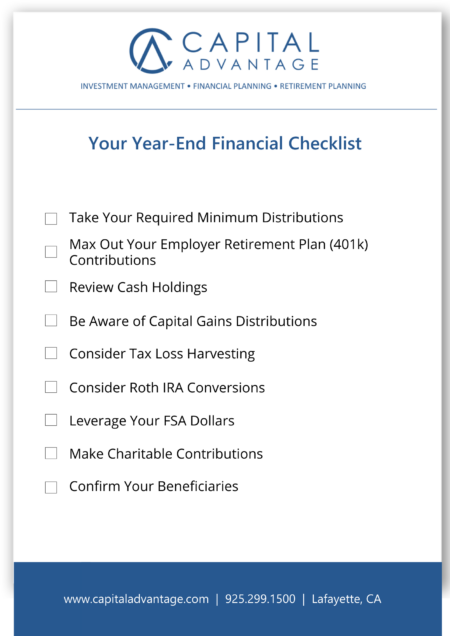

To simplify year-end management of your finances, here is a checklist of 9 important items to consider:

1. Take Your Required Minimum Distributions

As many of you know, your required minimum distributions (RMDs) are due before the end of the year. If you haven’t taken your distributions already, this is a reminder to check with your tax advisor, custodian, or financial advisor to confirm the amount, tax withholding elections, and instructions set up on your IRA.

2. Max Out Your Employer Retirement Plan (401k) Contribution

For those of you who want to max out your 401(k) contributions before the end of the year, now is the time to do it. Reference a recent paystub (or ask your HR department) to confirm if you’re on track. The goal is to max out your contributions on the last paycheck of the year. Review these contribution limits:

- 2021 Max Deferral – $19,500

- 2021 Over 50 Catch-Up Contribution – $6,500

- 2021 Max Deferral for Individuals Over 50 – $26,000

3. Review Cash Holdings

The end of the year is a great time to review your cash holdings/emergency fund balance. A general rule of thumb is 6-12 months of expenses for a single-income household and 3-6 months of expenses for a two-income household. Any large upcoming expenses (in the next year) should be factored into this calculation, as well.

4. Be Aware of Capital Gains Distributions

Be aware of expected capital gain distributions from mutual funds held in your portfolio. Mutual funds are legally required to distribute net capital gains each year (typically in November and December). If such mutual fund(s) are held in a taxable account (I.e., trust, individual), it’s good to be aware of the tax implication from the distribution.

5. Consider Tax Loss Harvesting

The end of the year is an opportune time to review which of your positions may have declined in value. Often, there are opportunities to sell a position at a loss, which could then be used to offset income or gains that have been incurred throughout the year. Coordinate with your accounting professional or financial advisor to best maximize tax efficiencies.

6. Consider Roth IRA Conversions

There are several reasons that it might make sense to convert some (or all) of a traditional IRA into a Roth IRA in a given year, including:

- The current year will be a low income-tax year.

- Once converted, Roth IRAs continue to grow tax-deferred

- Roth IRAs aren’t subject to annual RMDs

- Roth IRA distributions are tax-free (as long as you’re 59 ½ and have held the account for at least 5 years)

Given the complexity surrounding Roth conversions, you should work with your tax professional and financial advisor to determine if a conversion makes sense for your financial situation.

7. Leverage Your FSA Dollars

For anyone who contributes money to a Flexible Spending Account (FSA), remember that there is only a small amount ($550) that’s allowed to be carried over from year-to-year. That means, if you haven’t used the allowable $2,750 on eligible out-of-pocket expenses in 2021, you might want schedule that teeth cleaning or go get those new reading glasses you’ve wanted ASAP!

8. Make Charitable Contributions

If you’re charitably inclined, you can work with your tax professional and financial advisor to determine if you can reduce your taxable income through charitable donations before the end of the year. This can typically be done in the form of all cash donations, stock donations, or a combination of both. Please keep in mind that it typically takes some time for the charitable organization to process donations, so try to get this processed before mid-December.

9. Confirm Your Beneficiaries

This may be the easiest item on the list—and the most overlooked. Consult with your custodian(s), third party administrator, HR department, insurance broker, estate planning attorney, or financial advisor to confirm that the beneficiaries on your individual retirement accounts, insurance policies, etc. are current. Life changes—birth, marriage, death, etc.—may affect your choice of beneficiaries. Updating beneficiary designations is usually a very straightforward process that can often be completed electronically.

Download your Printable Checklist: Your Year-End Financial Checklist

As you work your way through this checklist, we invite you to reach out to us with any questions you may have.