Positives

- U.S. Federal Reserve Bank cut interest rates 0.50% in Q4 and 1.0% overall in 2024

- U.S. unemployment rate remains very low at 4.0%

- U.S. GDP growth was 2.3% in Q4 (advance estimate), down from 3.1% in Q3 (GDP slowed but remains strong)

- U.S. inflation rose slightly to 2.9% CPI trailing year in Q4

Risks and Concerns

- Trump Administration policies likely to be inflationary

- Artificial Intelligence sector appears overvalued

- U.S. imposed tariffs on international trade could slow global GDP growth

- New Trump Administration causing market uncertainty and volatility

The Quarter & Year in Review

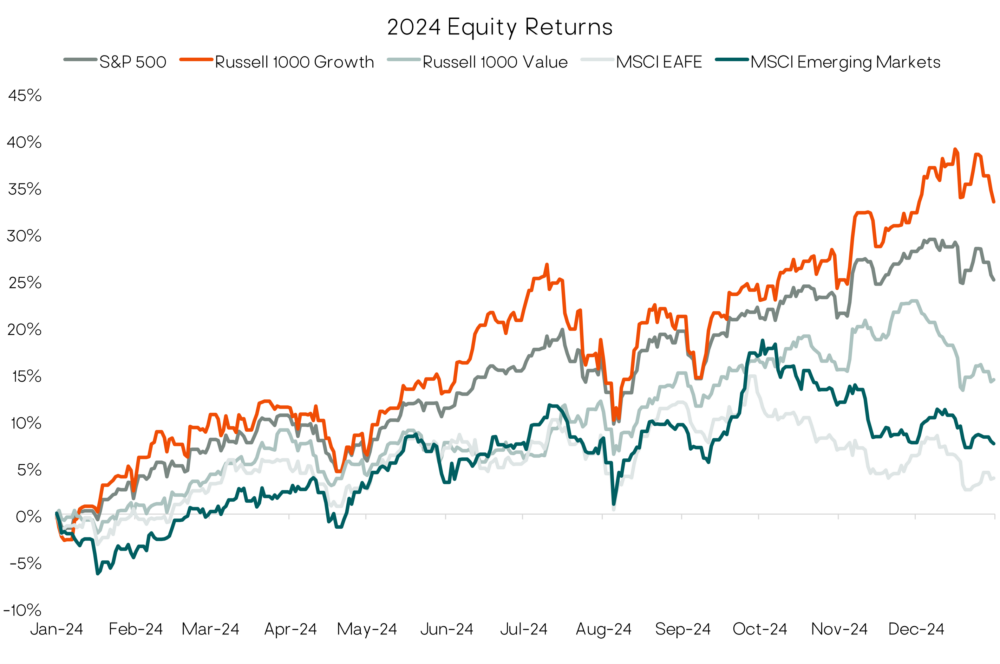

2024 was another strong year for most financial markets, led by approximately 30% returns in U.S. large capitalization growth stocks and a 25% return for the S&P 500 Index of U.S. large capitalization core stocks. Foreign equity markets greatly trailed domestic with low, single digit returns for diversified international indexes. Bond returns lagged equity returns, with the Bloomberg Aggregate Bond Index returning 1.25% for 2024. The outsize returns for U.S. large growth stocks were once again driven mainly by the Artificial Intelligence sector. The so-called “Magnificent Seven” largest U.S. technology stocks now account for 33% of the S&P 500 Index and collectively returned 60% in 2024. Fewer than 30% of the companies in the S&P 500 Index beat the index in 2024. The U.S. stock market continues to be very concentrated in the top 7 largest companies, all of which are in the technology sector. The following chart provides a visual of 2024’s returns for some of the major equity benchmarks:

Major Equity Index Returns For 2024

The biggest news of the 4th quarter (and 2024 overall) was certainly the presidential election of Donald Trump for a second time. The new administration has significantly different policy goals from the last, which are likely to include the extension of the 2017 tax cuts, corporate deregulation, tariffs, and immigration reform. Much of our current and future investment strategy will be dedicated to adapting to how the new administration will affect the markets and economy.

Current Investment Strategy

The first investment strategy adjustment due to changing policy in Washington we made in the last quarter of 2024 was reversing course on lengthening bond duration and beginning to shorten duration again. In 2024, we started to slowly and incrementally lengthen bond duration with purchases of the Vanguard Intermediate Term Corporate Bond ETF (VCIT) with the expectation that inflation and interest rates would continue falling. In general, falling interest rates increase bond performance; in particular, interest rate sensitive (longer duration) bonds. Unfortunately, it now appears that inflationary pressures that lead to rising interest rates may be returning because of several Trump Administration policies. The first of these are tariffs, which essentially function as a tax on the affected goods. Tariffs are paid by the company importing the tariffed goods, and companies normally raise prices to pass the increased costs to the consumer. Other inflationary policies are deportations and increased immigration restrictions, both of which increase labor costs by reducing the supply. The following chart displays the 5-year breakeven inflation rate, which functions as a gauge of future inflation expectations; the rate has been steadily rising since September of 2024:

5-Year Breakeven Inflation Rate (Expected Future Inflation Rate)

In response to inflationary government policies, we began to lower bond duration in mid-December, accomplishing this by loss harvesting taxable bond positions that had unrealized losses and placing proceeds in institutional money market funds. We also reduced allocations to the Vanguard Intermediate Term Corporate Bond ETF (VCIT), increasing our allocation to short-term bonds in turn. The rebalancing of these positions will continue in the current quarter.

Another investment update was a reduction of international equity and a corresponding purchase of the Financial Select Sector SPDR ETF (XLF). This was completed in the first quarter of 2025 due to expected deregulation of the financial sector by the Trump Administration, as well as higher interest rates. Historically, higher interest rates have benefitted financial institutions and led to a stronger dollar, which typically harms foreign companies by increasing their cost of trade with the U.S.

Future Asset Allocation Changes and Considerations

We intend to continue making changes to address what we see as elevated risks in global markets. The U.S. large capitalization growth equity sector is richly valued and therefore vulnerable to any negative developments. We witnessed a precursor to this early in the first quarter when news broke that China had created a less resource-intensive Artificial Intelligence model known as DeepSeek, triggering an abrupt selloff in the technology sector. In general, equities are also vulnerable to the elevated possibility of a U.S. government shutdown this quarter due to an extremely divided Congress. U.S. GDP growth slowed to 2.3% in the fourth quarter of 2024 (an advance estimate), down from 3.1% in quarter prior. It remains to be seen whether this trend will continue, but if so, it could certainly cause volatility.

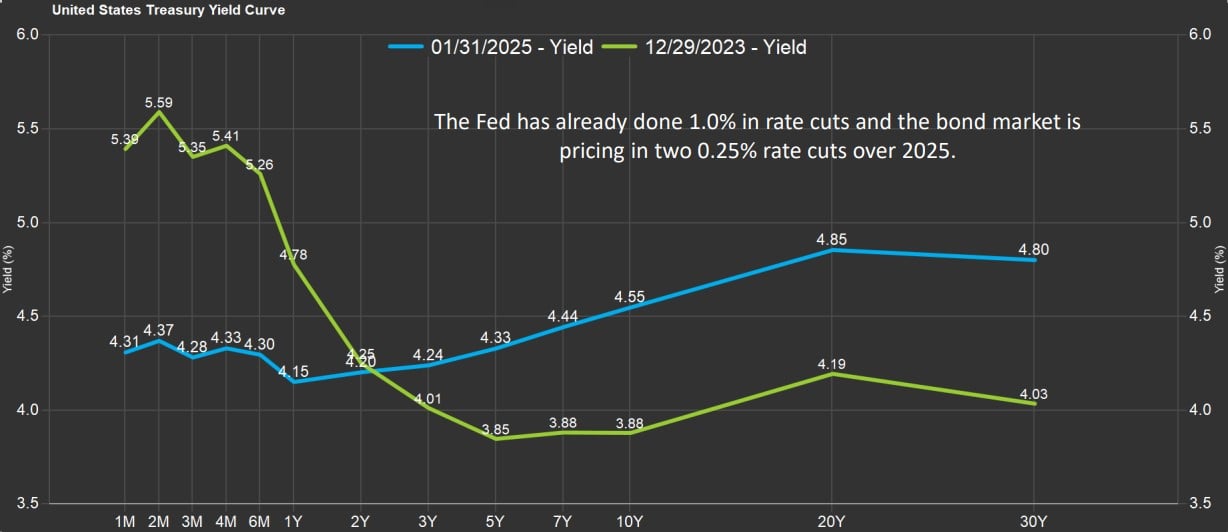

Short-term bonds are currently an attractive sector due to elevated yields of nearly 5% and lower risk, especially compared to equities. Tariffs, a stronger dollar, and persistent inflation could all conspire to keep interest rates relatively high. The following chart shows how the current U.S. Treasury bond yield has shifted over the past 2 years. Financial markets currently expect 2 more U.S. Fed interest rate cuts in the coming year, but there is also a significant possibility that no further cuts will occur due to the forces outlined above.

United States Treasury Yield Curve

Although we are currently focused on the risks to global markets, there is also the possibility that the Trump Administration’s efforts to deregulate business and cut taxes could lead to continued strong GDP growth and further positive market returns. We are attempting to take a balanced approach by overweighting sectors that we believe could perform well (i.e., financials) and reducing allocations to those sectors that may be negatively affected (i.e., international equities).

Key Investment Takeaways

- We lowered bond duration in Q4 2024 over concerns of persistent inflation and higher interest rates

- The Fed is expected to make 2 more 0.25% interest rate cuts in 2025, but they may also be done

- The Trump Administration has vastly different policy goals from the prior administration, requiring adjustments to our investment strategy

- Escalation of conflicts in the Middle East and Europe are a potential market risk factor

We will continue to monitor the market risks of this rapidly changing and difficult environment, frequently adjusting to help protect and grow your investment portfolio. As always, please feel free to call or email us with any questions or concerns.