Positives

- Corporate earnings remain strong despite sharply slowing economic growth

- U.S. inflation high, but declined to a 6.5% annual rate in December (down from 8.3% in September)

- U.S. unemployment rate remains healthy at 3.5% as of December 2022 (rates <5% are considered excellent)

- Fixed income and cash interest rates offering attractive yields (>4% on cash)

Risks and Concerns

- U.S. Federal Reserve remains hawkish (interest rates still rising in efforts to depress inflation)

- War in Ukraine continues, with risk of escalation between NATO and Russia

- Strong risk of recession

- U.S. Congressional debt-limit standoff could shake financial markets

- Corporate earnings are strong yet declining (stocks could face a difficult year as profits decline)

The Year in Review

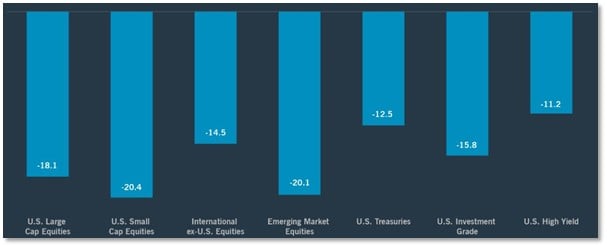

High inflation and rising interest rates caused significant financial market disruptions in 2022, causing both stocks and bonds to decline more than 10% in the same year for the first time in history. The S&P 500 U.S. large capitalization stock index fell 18% – it’s worst performance since the 2008 financial crisis. The Bloomberg U.S. Aggregate Bond Index declined by 13% – the worst U.S. bond market performance in almost 100 years. The following chart summarizes 2022 major asset class returns, illustrating significant declines across the board:

Total Return of Major Asset Classes in 2022 (%)

Inflation remained persistently high throughout 2022 (8.2% Consumer Price Index annual rate in September), prompting the U.S. Federal Reserve to respond by aggressively raising interest rates. The Federal Reserve made 4 sequential rate hikes of 0.75%, followed by a 0.50% hike in December, ending 2022 with a federal funds rate of 4.5%. The good news is that these rising interest rates did have an effect, with December CPI declining to a 6.5% annual rate.

Inflation coupled with rising interest rates was the largest driver of poor financial asset returns in 2022. To address these market conditions, we made numerous investment strategy changes. Bond allocations were updated to focus on investments significantly less interest rate sensitive than the total bond market, and equity allocations were reduced repeatedly; both strategies had the intended effect of reducing ‘down market capture’. The following is a recap of risk reduction moves made in the last 1.5 years:

2021

Q2:

- Sold long duration bonds; bought floating rate bonds. Reason: Lower duration and thus, interest rate sensitivity.

Q4:

- Sold additional long durations; bought additional floating rate bonds. Reason: Further lower duration.

2022

Q1:

- Sold all remaining long duration bonds; bought more floating rate bonds. Reason: Further lowering of bond duration to protect against rising interest rates

- Sold Total Return Bond Fund; bought Mortgage-Backed Bonds. Reason: mortgage-backed securities typically perform better than the overall bond market during times of rising interest rates, utilizing derivatives to enhance returns.

- Sold Short Maturity Bonds; bought floating rate bonds. Reason: Floating-rate bonds are more positively correlated with rising interest rates than short-term bonds.

Q2:

- Sold 1-10% (depending on allocation model) High-Yield bonds; bought Floating Rate Bonds. Reason: Move from high-yield bonds to higher credit quality floating-rate bonds.

- Sold Asia Stock Investments; bought Ultra Short-Term Bonds. Reason: Reduce allocation to China and Asia equity in favor of short-term bonds.

- Sold Emerging Market Stocks; bought International High Dividend Stocks. Reason: Move from risky emerging markets to less volatile international value equity.

- Sold International Stock Index; bought short-term bonds. Reason: Reduce international equity approximately 4% in favor of short-term bonds.

Q3:

- Sold European Stock Index; bought short-term bonds. Reason: Reduce equity roughly 1% in favor of short-term bonds.

- Sold Financial Sector Stocks; kept proceeds in cash. Reason: Reduce equity approximately 1% in favor of cash.

Current Portfolio Strategy

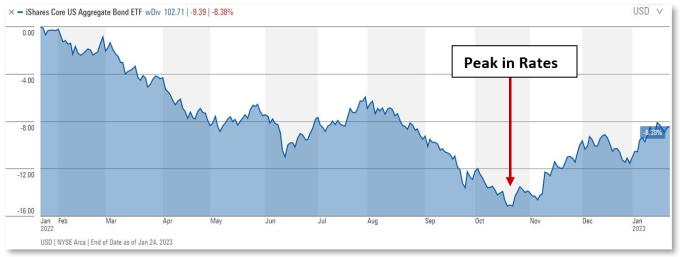

After a year of significant interest rate hikes, we believe that intermediate-term interest rates and inflation are likely already at, or near, their peak for this rate hiking cycle. The Federal Reserve is likely to raise rates by 0.25% in their January 2023 meeting and then pause rate hikes—but unlikely to begin cutting rates in 2023, barring a severe downturn in the economy. The following chart is the total return for the Bloomberg U.S. Aggregate Bond Index in the last year (January 24, 2022, to January 23, 2023). Given that bond prices move inversely to interest rates, it appears that interest rates may have peaked in late October of 2022 and have fallen since.

U.S. Aggregate Bond Index Trailing Year Performance

Following our forecast that inflation and interest rates have likely peaked, we began to move incrementally into longer duration bonds in the first week of 2023, intending to capitalize on the higher interest rates these bonds offered, as well as benefit from potentially falling interest rates later this year. We took positions (1-3% of portfolios, depending on allocation model) in Intermediate-Term Corporate Bonds with proceeds generated from the sale of short-term bonds (or cash). Using proceeds from floating rate and shorter duration bond positions, we intend to continue moving into longer duration bonds throughout 2023.

Last November, we sold positions in Asia-focused stock holdings, representing an approximate 1% reduction in equity allocations. This was likely our last equity reduction move for the current economic cycle unless recessionary indicators grow in magnitude and signal the possibility of a severe recession.

We also completed significant tax-loss harvesting in the last quarter of 2022. Tax-loss harvesting allows us to sell investments that are down, replace them with reasonably similar investments, and then offset realized investment gains with those losses. The result is that less of your money goes to taxes and more can stay invested and working for you.

Future Asset Allocation Changes and Considerations

We forecast an economic slowdown in 2023, and likely a mild recession as we enter the summer months. It’s unlikely that financial markets have absorbed the full impact of the recent interest rate hikes, which should have a significant slowing effect. This anticipated slowdown is likely to coincide with declining inflation and interest rates as economic activity cools. Additionally, corporate earnings are expected to decline beginning this quarter, and the index of Leading Economic Indicators was down 1% in December, and down 4.2% over the 6-month period from June to December of 2022.

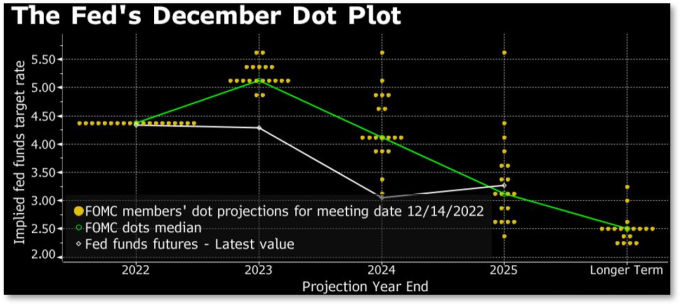

In acknowledgement of the slowing economy, the Federal Reserve has started to release projections evidencing the likelihood of an end to their interest rate hiking cycle. The following chart shows each of the Federal Reserve members’ projections on the future path of interest rates; most forecast only another 0.50% in rate hikes in 2023, with rate cuts likely beginning in 2024.

The Federal Reserve’s December Dot Plot

Now that inflation is abating, we believe there is a high probability that bonds will outperform stocks in 2023, and interest rates could start to fall as the year continues. As such, we have already reduced portfolio equity exposure substantially in favor of fixed income, and now plan to focus efforts toward further increasing bond duration exposure.

Key Investment Takeaways

- We reduced equity significantly in 2022 to help protect against declining equity markets

- We intend to continue an overweight fixed income strategy for much of 2023

- Higher interest rates and declining inflation in 2023 makes bonds far more attractive than in 2022

- The Federal Reserve is likely approaching the end of their interest rate-hiking cycle

- A mild recession in 2023 is expected

We will continue to monitor the market risks of this rapidly changing and difficult environment, continually adjusting to help protect and grow your investment portfolio.

Your Capital Advantage Team