Positives

- Corporate earnings remain strong despite sharply slowing economic growth

- U.S. unemployment rate remains at a very low at 3.5%

- Fixed income and cash interest rates offering attractive yields

Risks and Concerns

- Very high inflation of 8.3%, as measured by headline CPI (as of 9/13/2022)

- U.S. Federal Reserve Bank still very hawkish

- War in Ukraine continues, causing inflationary pressures

- Rising risk of recession

The Quarter in Review

The third quarter of 2022 continued a very difficult year, as high inflation and rising interest rates weighed heavily on both equity and fixed income markets. One of the most significant market driving events occurred with the September 13 inflation index release, which showed CPI (Consumer Price Index) inflation rising 0.1% on the month and at an 8.3% annualized rate. Core CPI (which excludes volatile food and energy prices) was up 0.6% on the month and 6.3% on the year. The Federal Reserve gives more significance to core CPI, and such a large increase above the Federal Reserve’s 2% target rate triggered a major multi-day selloff in equity and fixed income markets worldwide. The unfortunate reality is that inflation continues running hotter than expected, and the Federal Reserve will most likely need to continue raising interest rates to combat this. By the end of the third quarter, all major market benchmarks were down significantly:

Major Index Returns

| Index Name | Index Description | Year to Quarter End (9/30/22) Return |

|---|---|---|

| Bloomberg U.S. Aggregate | U.S. aggregate bond market | -15.17% |

| S&P 500 | U.S. large capitalization equities | -23.76% |

| S&P 400 | U.S. mid capitalization equities | -19.29% |

| S&P 600 | U.S. small capitalization equities | -20.87% |

| NASDAQ | U.S. technology equities | -32.95% |

| MSCI EAFE | International large capitalization equities | -27.25% |

| MSCI EAFE EM | Emerging markets equities | -28.08% |

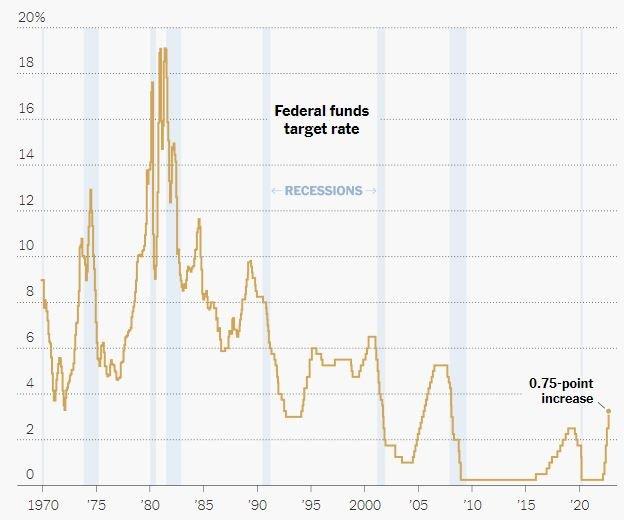

In September, in response to continued high inflation numbers, the U.S. Federal Reserve Bank raised the federal funds rate for a fifth consecutive time to a range between 3% and 3.25%. Given that the federal funds rate was at zero at the beginning of 2022, this has been the fastest pace of interest rate hiking in 40 years, with the last 3 consecutive hikes unusually large ones of 0.75%. Below is an illustration of the current rate hiking cycle in relation to previous such cycles—note the steepness of the line in the current hiking cycle:

Federal Funds Rate, 1970 – Present

Revised second quarter GDP came in at -0.6%, after a first quarter reading of -1.6%. The traditional definition of a recession is two consecutive quarters of contracting GDP, which would indicate that we are currently in a recession, however, unemployment is still extremely low, corporate earnings are strong, and U.S. consumer spending remains high. The National Bureau of Economic Research (NBER) defines a recession as a significant decline in economic activity across the economy lasting more than a few months, so by this definition, we have not yet entered a recession. Regardless, the forecasts of recession have been rising significantly, and if we are not officially in one now, the odds of entering a recession within the next few quarters have definitely heightened.

Current Portfolio Strategy

Our investment strategy continues to focus on our year-long theme of risk reduction, and equity allocations were further reduced at the end of August. Equity holdings in Europe were sold, with proceeds allocated to Ultra Short-Term Bonds, representing an approximate 1% reduction to portfolio equity allocations. This change was primarily due to the war in Ukraine that continues to create energy supply issues to Europe—issues that are likely to worsen during the upcoming winter season.

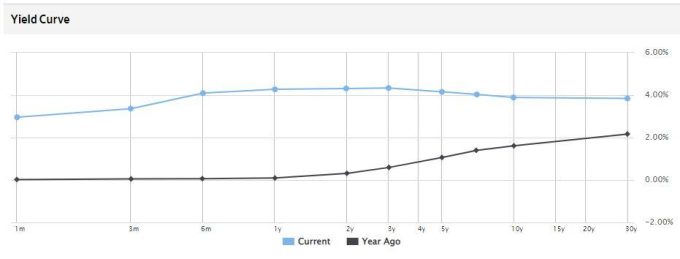

Bond holdings remain very short in duration, helping to protect against the negative effects of rising interest rates. In addition, many shorter-term bonds are now yielding more than longer-term, as the Federal Reserve continues to push up interest rates on the short end of the yield curve. High inflation also pushes market forces to increase short-term interest rates because bond investors demand higher yields to compensate for this elevated inflation. When bond maturities beyond 3 years yield less than shorter-term bonds, this creates a phenomenon known as the yield curve inversion (illustrated below). In a normal sloped yield curve (as represented by the 2021 line below), interest rates are greater for longer maturity bonds in order to compensate investors for the increased risk of lending money for a longer period:

Yield Curve: 2021 vs. 2022

An inverted yield curve is a strong recession predictor, in part because it forecasts that interest rates are expected to fall in the future. On the bright side, an inverted yield curve also signals that the bond market is forecasting for inflation to fall in the not-so-distant future. Once the Federal Reserve signals that they will pause their rate hiking cycle and inflation appears to be under control, we intend to make efforts to lock in higher interest rates by extending duration in bond portfolios by investing in bonds that mature at dates further in the future.

In the short term, we intend to reduce equity allocations further in an effort to minimize the effects of an equity bear market. For example, just after the end of the third quarter, we sold the Financial Sector equities in exchange for cash, which represented an approximate 3% reduction to portfolio equity weightings. The financial sector typically benefits from rising interest rates, but as we are witnessing now, also suffers as the economy slows. Furthermore, as alluded to above, interest rates will likely stop rising within the next year as the economy continues to slow, which places downward pressure on inflation.

Future Asset Allocation Changes and Considerations

We are currently operating under the assumption that there will be a recession next year, likely in the first half of 2023—this is not only due to high inflation and rising interest rates, but because the Conference Board Leading Economic Index® (LEI) has now dropped for 6 straight months and the yield curve is inverted. The Federal Reserve is expected to raise interest rates by another 0.75% at their next meeting in November. If CPI core inflation drops after this meeting, the next interest rate hikes may slow to 0.50% or the Federal Reserve may even pause their rate increases, which would certainly be welcome because it’s likely that the economy has yet to absorb the full effects of the interest rate hikes already made.

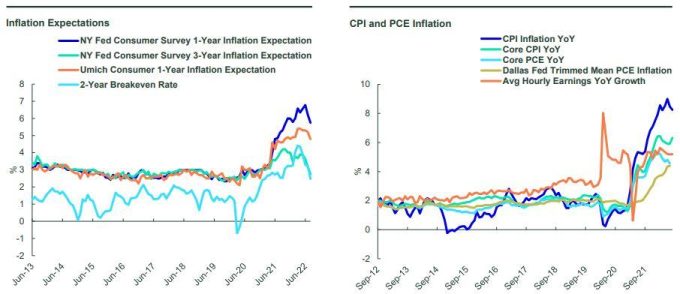

We are seeing some positive signs with supply chain problems easing and commodity prices declining, both factors which provide some relief on the inflation front. The following charts show that consumer inflation expectations are decreasing (left chart) and that CPI headline inflation numbers are beginning to decline on a trailing year basis (right chart), which means that at a minimum, the rate of inflation increase is slowing, and we may finally see inflation readings decline in the coming months.

Inflation Expectations & Inflation Index

Despite these positive signs that inflation may be peaking soon, our investment strategy is still in a defensive risk-reduction posture. We intend to wait for market conditions to settle prior to our next planned move of selling international equity and keeping proceeds in cash. The unfortunate reality is that if the economy does enter a recession in the coming months, there will likely be further equity market declines ahead, so our main goal is mitigating the impact of these possible future declines. However, with the significant rise in interest rates this year, we are beginning to see attractive yields and opportunities in the bond market, as well as the opportunity to earn competitive interest rates on cash.

Key Investment Takeaways

- Continued portfolio equity allocation reduction efforts to help guard against declining equity prices

- Federal Reserve Bank remains in a hawkish interest rate hiking cycle to combat high inflation

- High inflation and rising interest rates severely damaging financial markets’ performance

- Heightened risk of recession

- War in Ukraine continues to destabilize financial markets and drive inflation

- Attractive opportunities appearing in fixed income due to yields rising

- Cash yields the highest they’ve been in several years, rewarding savers well

We will continue to monitor the market risks of this rapidly changing and difficult environment, continually adjusting to help preserve and protect your investment portfolio. As always, please feel free to call or email us with any questions or concerns.

Your Team at Capital Advantage