Positives

- U.S. Federal Reserve Bank paused rate hiking cycle in June

- U.S. unemployment rate remains healthy at 3.6% as of June 2023 (up slightly from 3.5% in March)

- Fixed income and cash interest rates offering attractive yields (>4% on cash)

- Technology stocks performed well due to artificial intelligence led rally

Risks and Concerns

- U.S. Federal Reserve Bank remains hawkish with further interest rate hikes planned for this year

- U.S. corporate earnings fell 5.9% in the 1st quarter of 2023, following a 2.7% decline in the prior quarter

- Elevated risk of recession later this year

- CPI inflation rose at a 3% annual rate in June after a 4% annual rate in May, above the Fed’s target but declining

The Quarter in Review

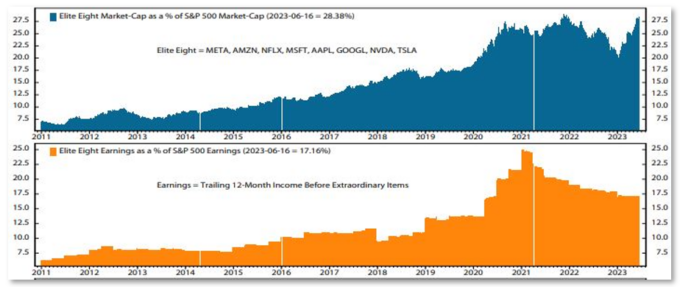

The 2nd quarter of 2023 began with a surprising rally in U.S. large capitalization growth stocks, led by investor excitement about artificial intelligence (AI). This rally resulted in the NASDAQ Composite Index gaining back most of its 2022 steep losses, though it’s still not back to its November 2021 peak. The rally was primarily driven by a handful of technology stocks known as the Elite Eight: Alphabet (GOOGL), Amazon (AMZN), Nvidia (NVDA), Meta (META), Apple (AAPL), Netflix (NFLX), Microsoft (MSFT), and Tesla (TSLA). Notably, these are mega capitalization stocks, so our allocation to mega capitalization equities benefitted from the rally despite our overall decreased equity allocation. AI has been around for quite some time, but marketing attention surrounding AI has led to increased investor interest. Unfortunately, this 2nd quarter rally has had low overall market participation, with the Elite Eight stocks driving most of the market performance. So, unless an investor held at least one of these stocks in their portfolio, they likely didn’t reap the benefit of the rally. The following charts show how these stocks accounted for 28.38% of the total market capitalization of the S&P 500 and 17.16% of its total earnings, an abnormal over-weight to so few stocks.

Elite Eight: Market-Cap vs. Earnings

(Weekly Data 2010-12-31 to 2023-06-16)

Source: Ned Davis Research, Sector Briefing, June 23, 2023

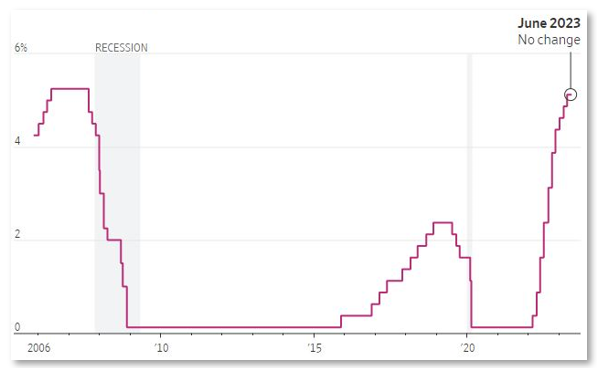

In another important development during the quarter, the U.S. Federal Reserve Bank (the Fed) elected to pause their interest rate hiking cycle at their June 14th meeting. The Fed had raised rates in 10 consecutive meetings since March 2022, for a total interest rate increase of 5% – the most rapid rise in the Federal Funds Rate since the 1980s. Normally, a pause in interest rates would be welcome news to the stock market and add fuel to the AI rally…but instead, the last Fed meeting poured cold water on that. Fed Chair Jerome Powell signaled a hawkish pause in interest rate hikes, making it clear that the Fed still considers inflation a significant threat, and forecasted at least 2 more rate hikes before the end of 2023. Powell believes the full impact of the past cumulative rate hikes has yet to impact the economy, making a pause in interest rate hikes to await future economic data a prudent choice.

The overall economy remained resilient despite the significant rise in interest rates, with the third estimate of 1st quarter’s gross domestic product (GDP) coming in at 2% annualized. This is an average rate of economic growth, and a slightly slower rate of 1.7% is currently forecast for the 2nd quarter. Consumer spending grew at a 4.2% annualized rate in the 1st quarter, the fastest pace since mid-2021 when the economy was rebounding aggressively from COVID-related shutdowns. On the other hand, U.S. corporate earnings fell 5.9% in the 1st quarter of 2023, following a 2.7% decline in the 4th quarter.

These developments, in aggregate, indicate that a U.S. recession now appears that it would be milder and later than expected, but still expected (at least according to the research sources and forecasters that we follow).

Current Portfolio Strategy

We remained defensive in our investment strategy in both stocks and bonds during the 2nd quarter. Overall, we are underweighting equity in favor of the attractive yields from short duration bonds but did benefit from the recent technology rally due to exposure to mega capitalization technology companies that have performed extremely well year-to-date.

Within our fixed income allocation, we aimed to lengthen duration mid-May by exchanging a portion of the iShares Floating Rate Bond ETF (FLOT) to the Vanguard Intermediate-Term Corporate Bond ETF (VCIT). This was done in anticipation of the upcoming end to the Fed’s interest rate hiking cycle as inflation continued to ease during the quarter. Inflation, as measured by the Consumer Price Index (CPI), rose at a 3% annual rate in June following a 4% rise in May – a promising trend as inflation continues to fall from its peak of 9% in June 2022.

Despite this positive news on the inflation front, the Fed remains hawkish toward inflation even when they elected not to raise rates this past June. The following chart shows the current level and recent history of Fed controlled interest rates. The Fed is still projecting at least two more 0.25% interest rate hikes before the end of 2023.

Federal-Funds Rate Target

Source: The Wall Street Journal, June 14, 2023

Future Asset Allocation Changes and Considerations

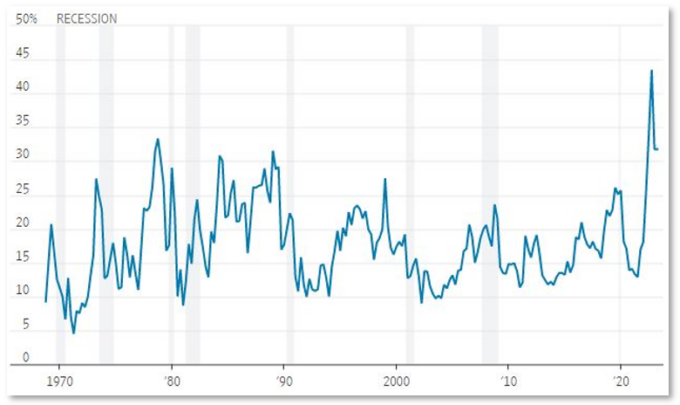

As we move into the second half of the year, it’s becoming clear that the probability of a recession is receding, and it may be possible for a soft landing from the high inflation and slowing economy we’ve experienced over the past year. The following chart is a compilation of professional economist forecasts from the Federal Reserve Bank of Philadelphia that shows expectations for a recession declining by at least 10% over the past quarter:

Probability of Recession in Four Quarters

Source: The Wall Street Journal, June 23, 2023

If inflation numbers continue to decline and we see a rebound in corporate earnings, we are likely to pivot from our current underweight to equities. In fixed income, we intend to pause our efforts at extending duration and wait for more concrete language from the Fed that they are finished with their cycle of rate hiking. Short-term and floating rate bonds are yielding slightly more than 5% and the yield curve remains inverted, so further duration extension will be predicated on a forecast for declining interest rates, which is not yet on the near horizon.

In the bigger picture, the bond market still indicates a recession given the inverted yield curve, one of the strongest recession predictors available. We have also witnessed two quarters in a row of sharply declining corporate earnings, which is a negative sign for future economic growth. The housing market continues to slow given high interest rates and the continued problems with regional bank balance sheets. Only the AI sector of the U.S. stock market seems to indicate that a new bull market has begun. Therefore, we feel it is best to continue to remain defensive in our overall investment strategy. We will look to increase equity allocations during the next market sell-off, or if the overall economic data begins to read more positively. Should either of these events occur, we plan to increase domestic small and mid-capitalization stocks, as well as add to large-capitalization growth stocks at the expense of large-capitalization dividend-paying stocks.

Key Investment Takeaways

- We are currently positioned defensively in both stocks and bonds

- Given declining earnings (profits) and high prices, we believe that equity valuations may soon struggle

- We intend to continue an overweight fixed income strategy for much of 2023, until we see a stock market correction

- High interest rates and declining inflation makes fixed income investments more attractive than they were in 2022

- As inflation recedes, the U.S. Federal Reserve is likely approaching the end of their interest rate-hiking cycle

- A mild recession in late 2023 or 2024 is still predicted by most economic indicators

We will continue to monitor the market risks of this rapidly changing and difficult environment, frequently adjusting to help protect and grow your investment portfolio. As always, please feel free to call or email us with any questions or concerns.

Your Capital Advantage Team