Positives

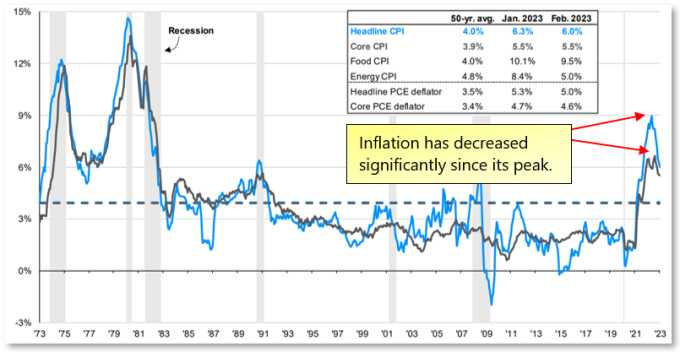

- U.S. inflation declined from 6.3 % annual rate in January to 5% in March

- U.S. unemployment rate remains healthy at 3.5% as of March 2023 (rates <5% are considered excellent)

- Fixed income and cash interest rates offering attractive yields (>4% on cash)

Risks and Concerns

- U.S. Federal Reserve Bank remains hawkish (interest rates still rising in efforts to depress inflation)

- Multiple small bank failures required government intervention

- U.S. corporate earnings fell 2.7% in the fourth quarter of 2022

- Elevated risk of recession later this year

The Quarter in Review

The first quarter of 2023 began with a stock and bond market rally driven by a trend of declining inflation and a belief that the U.S. Federal Reserve Bank would soon pause their rate hiking cycle. Higher than expected inflation readings in January triggered an equity and bond sell-off that drove up interest rates once again (bond prices and interest rates move in the opposite direction). Rising interest rates created a crisis for a few small independent U.S. banks, most notably Silicon Valley Bank (SVB). After a failed attempt to raise capital, SVB faced a classic “run on the bank”, as worried depositors pulled their funds, forcing SVB to sell long term treasury bonds to meet withdrawals. Rising interest rates had reduced the market value of these bond positions, forcing the bank to realize large losses that tipped them into insolvency. SVB was soon taken into receivership by the FDIC, who elected to fully insure all depositors — while wiping out the bank’s equity holders and significantly marking down the bond holders. A private buyer for SVB has since been found (First Citizens Bank).

The silver lining in this small bank crisis is that the financial system has absorbed the shock without further contagion. Larger U.S. banks are subject to Dodd-Frank regulations which mandate higher reserve requirements, and thus the fallout was contained to only a few smaller banks. However, this event will likely lead to tightened credit conditions as other banks become more reluctant to lend, which could contribute to an economic slowdown. Furthermore, risk remains with smaller banks that have made commercial real estate loans as commercial real estate is a sector that continues to struggle.

Despite these banking sector problems, the U.S. Federal Reserve Bank stuck to its interest rate hiking plan, raising rates by 0.25% on March 22 in efforts to tamp down inflation. Current market expectations assume another rate hike of 0.25% in May, with possible rate cuts in late 2023. It appears that the U.S. Federal Reserve Bank’s rate hiking cycle is having the intended effect of lowering inflation, as the Consumer Price Index (CPI) inflation measure rose 0.5% in January, 0.4% in February, and 0.1% in March. While the CPI remains higher than the U.S. Federal Reserve would like, the following chart illustrates the clear trend of inflation coming down from much higher levels in 2022.

CPI and Core CPI

(% Change vs. Prior Year, Seasonally Adjusted)

The prolonged period of high inflation and elevated interest rates has started to have a measurable impact on the overall economy. Fourth quarter 2022 GDP measured at a 2.6% annual growth rate, down from 3.2% in the third quarter of 2022, indicating a slowing rate of U.S. economic growth. Unemployment remains low at 3.5% in March and may help to provide support to a slowing economy.

Current Portfolio Strategy

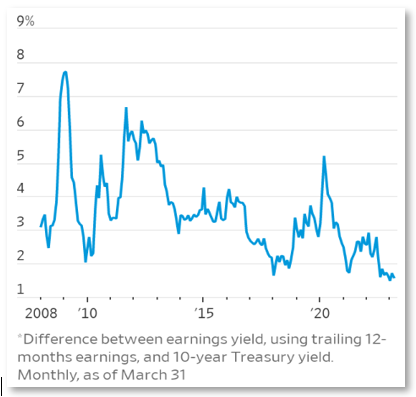

Our current portfolio positioning remains underweight to equity (overweight to value dividend-paying stocks within equity allocations) and overweight to fixed income. After this last year of rising interest rates, bonds appear more attractive relative to stocks– more so than they have been in many years. One of the ways this valuation difference between stocks and bonds can be measured is with the equity risk premium, which is the difference between the earnings yield on stocks and the yield on bonds (the earnings yield is the inverse of the price-to-earnings ratio or earnings/price = earnings yield). A lower equity risk premium makes bonds relatively more attractive than equities; the following chart shows equity risk premiums for the S&P 500 Index at their lowest point since October 2007.

S&P 500 Equity Risk Premium

We aim to be positioned defensively within our equity allocation, overweighting allocations to sectors like consumer staples, healthcare, and dividend-paying value stocks. Both dividend and value stocks serve as a hedge against inflation, and consumer staples and healthcare sectors historically perform well in a slow-growth economy.

Future Asset Allocation Changes and Considerations

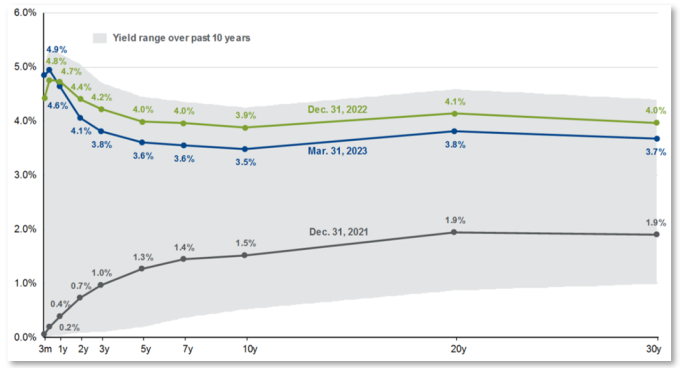

We forecast the risk of a U.S. recession later this year remains elevated, especially after last month’s regional bank failures. Higher interest rates coupled with stricter lending standards should serve as a brake on economic growth, continuing the trend of slowing GDP growth. Furthermore, the U.S. Treasury yield curve remains inverted; an inverted yield curve is one of the strongest recession indicators that exists today. Every U.S. recession has been preceded by an inverted yield curve, though not every inversion has led to a recession. The following chart shows the yield curve inverting over the last two years, with March 31, 2023, short-term rates yielding more than a full percentage point higher than 10 and 20-year yields.

U.S. Treasury Yield Curve

Guide to the Markets – U.S. Data are as of March 31, 2023

Within fixed income allocations, we plan to reduce floating rate and interest rate hedged positions, both of which have served their intended purpose of helping to limit the effects of rising interest rates on bond portfolios. However, we believe we are nearing the end of rising interest rates, therefore, we intend to shift to longer maturity bonds. Longer maturity bonds typically outperform short duration bonds as interest rates remain stable or fall, a situation we are likely to experience later this year or next.

We are confident the equity allocation reductions we have already made are sufficient to weather a possible recession. Even so, we will continue to seek opportunities to purchase equities should it appear that we are instead heading toward a soft landing from the current high interest rate and inflationary environment.

Key Investment Takeaways

- We reduced equity allocations significantly in early 2022 to guard against declining equity prices

- Given declining earnings (profits) and high prices, we believe that equity valuations may soon struggle

- We intend to continue an overweight fixed income strategy for much of 2023

- 2023 high interest rates coupled with declining inflation makes fixed income appear more attractive than in 2022

- The U.S. Federal Reserve is likely approaching the end of their interest rate-hiking cycle

- A mild recession in late 2023 or 2024 is expected

We will continue to monitor the market risks of this rapidly changing and difficult environment, frequently adjusting to help protect and grow your investment portfolio. As always, please feel free to call or email us with any questions or concerns.

Your Capital Advantage Team