Positives

- U.S. unemployment rate remains low at 4.2% in March

- U.S. GDP growth was 2.4% in Q4 2024 (3rd estimate)

- U.S. inflation at 2.8% CPI trailing year in Q1

Risks and Concerns

- U.S. government policies likely to be inflationary

- U.S. imposed tariffs on international trade could slow global GDP growth & possibly cause a recession

- Tariffs currently causing market uncertainty & volatility

The Quarter and Year in Review

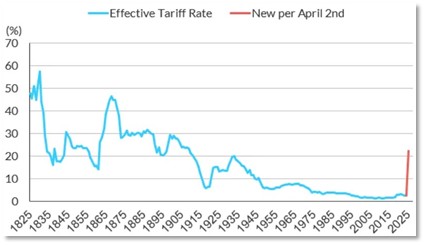

The first quarter of 2025 began with the poorest stock market performance since 2022, primarily due to the U.S. implementation of international trade tariffs. Tariffs are taxes on imported goods paid by the importing company that are typically passed to consumers as companies raise prices on affected goods. The newly implemented tariffs represent the largest tax increase on Americans in decades and are likely to slow the economy by decreasing consumer spending. The following chart shows the increase in the U.S. effective tariff rate from the historical average (an average increase from about 3% to approximately 25):

U.S Effective Tariff Rate

The stated rationale for the tariffs is to help bring back domestic U.S. manufacturing jobs, which is certainly a noble goal. However, this method is unlikely to work since tariffs increase the cost of raw materials producers need to import for production, and they are inflationary as importers increase the cost of goods. Therefore, the reason markets have adjusted so dramatically is because these tariffs are likely to slow GDP growth by directly impacting consumer spending and manufacturing costs.

Another factor that is likely to slow growth is the government’s aggressive job-cutting administered by the new department known as DOGE. DOGE has terminated many government employees which will increase the unemployment rate and likely further lower consumer spending.

Current Investment Strategy

Our investment strategy is in risk reduction mode to help protect against the negative market effects of the new tariffs. Earlier this quarter, we repurchased PIMCO bond funds PIMIX and PMZIX with money market funds (cash). Cash allocated to these PIMCO positions had been temporarily parked in money market funds after the securities were tax loss harvested in late December of 2024. Although cash is a safer place to be in the current environment, we anticipated that these bond positions would appreciate as investors sought a flight to quality (selling assets perceived as risky and purchasing typically safer assets), which is occurring now.

On March 19th, we also reduced small capitalization equity by about 2% (of total portfolio weighting), with proceeds going directly to money market funds (cash). Small capitalization equity is one of the riskiest equity sectors, and this move was designed to directly remove risk with the anticipation of tariffs slowing the global economy.

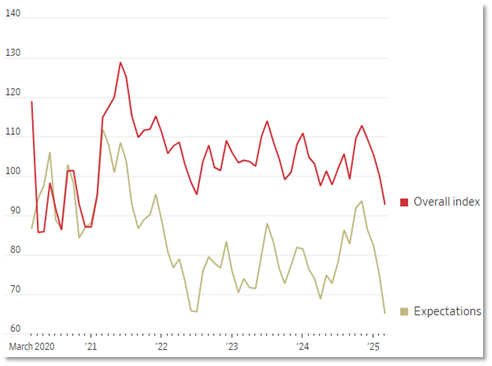

Another issue to note is that even prior to the announcement of significant additional tariffs on April 2nd, U.S. consumer confidence had already been in decline. The following chart shows that consumer confidence and future expectations had fallen to their lowest level in 12 years. Because tariffs function as a direct tax on consumption and are regressive (affect lower income consumers more), we expect to see a significant slowdown in consumer spending (and therefore, global GDP growth), if the tariffs remain in place.

Conference Board Consumer Confidence

Future Asset Allocation Changes and Considerations

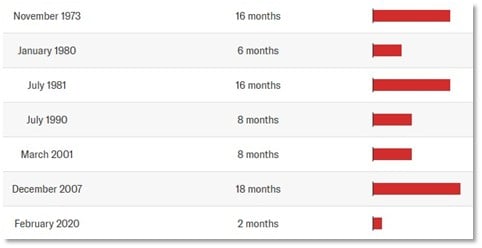

The big question markets are asking is, “Will we have a recession?” We believe that if the April 2nd tariff increases remain in place, we are likely to have a recession (a recession is typically defined as 2 consecutive quarters of decline in GDP). The U.S. Federal Reserve bank forecasted GDP growth of 1.7% for 2025, and this was prior to the large tariff increases. The Fed also projected inflation to rise to 2.7% this year, which was also prior to the April 2nd tariff increases. The combination of slowing growth and rising inflation greatly increases the probability of recession. The following table displays the length of recent historical recessions:

U.S. Historic Recession Length

Due to the increased chances of recession, we plan further risk reduction in the coming quarter. We plan to reduce allocations to mid-capitalization equities, selling approximately 2% of applicable portfolios to money market funds (cash). We are also considering the exchange of a few riskier equity holdings for historically lower risk investments, such as long/short funds or investments that target low volatility equities.

Key Investment Takeaways

- We lowered small capitalization equity allocation by approximately 2% in applicable portfolios

- The U.S. has enacted tariffs on global trade that have increased the risk of recession

- We plan to make further risk reduction moves in the current quarter

We will continue to monitor the market risks of this rapidly changing and volatile environment, frequently adjusting as needed with the goal of protecting and growing your investment portfolio. As always, please feel free to call or email us with any questions or concerns.