Just as a lack of financial planning can affect your investment portfolio and your financial future, misunderstanding or a failure to adhere to the rules surrounding required minimum distributions (RMDs) could cost you money in the form of stiff penalties and potential loss of income.

The basics of RMDs

- An RMD is the minimum amount you must withdraw every year, after you turn 73 (or 75 depending on your date of birth), from your qualified tax-deferred retirement accounts, which includes employer-sponsored retirement plans, traditional IRAs, SEP-IRAs, and SIMPLE IRAs. Since an RMD is the required minimum amount, you can always withdraw more than that amount.

- RMDs are in place so the Internal Revenue Service can tax income that has previously been held in tax-deferred accounts.

Important things you should know about RMDs

To help preserve your hard-earned savings, let’s take a closer look at a few important things you should know about these pesky RMDs.

1. Know when you are required to start taking your RMDs – the starting age rule has changed!

Your friend, who started taking their RMD a few years ago, may have told you that you must start taking RMDs when you turn 70 ½. Careful—the rules have changed! The long-standing RMD starting age of 70½ was adjusted to 72 starting in 2020 and 73 starting in 2023 with the SECURE Act 2019 and 2022 legislation. Wait, there’s more. In 2033, the RMD age will increase to 75!

Note: You have until April 1st of the year after you turn 73 (or 75 depending on your date of birth) to take your first RMD. After that, you must begin withdrawing RMDs annually by December 31st.

2. RMDs are not optional!

Required minimum distribution means exactly that – required. You are legally required to take RMDs from your tax-deferred retirement accounts each year, even if you don’t need the money. If you don’t take your RMD each year or you take too little, you could end up paying the IRS a penalty on the amount that was not distributed. While the penalty was reduced in 2023 from a whopping 50% to 25%, it’s still a hefty price to pay. For example, if your RMD for the year was $100,000 and you only took $50,000 out, then you could owe the IRS 25% of the amount not distributed! That’s $12,500 you must pay to the IRS for your mistake. Note: The penalty may be reduced to 10% if the full amount is distributed in a timely manner before the IRS asses a penalty.

While you must withdraw your annual RMD, you don’t have to spend the distributed money. If you don’t need the RMD for living expenses, you can reinvest it (but not into another tax-advantaged account) or have your custodian transfer the RMD from your IRA directly to your favorite charity, as a qualified charitable distribution (QCD).

Speak with your financial advisor about the best options for you and your individual needs when it comes to financial planning.

3. How to calculate your RMD

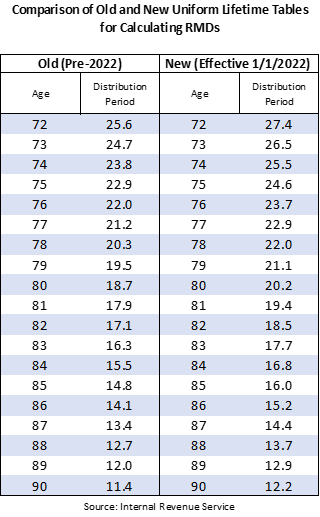

To calculate your RMD, divide the previous year-end balance of each qualifying account by your life expectancy factor (distribution period) as defined by the IRS Uniform Lifetime Table (see chart below).

For example, let’s say Allen is 74 and single. Allen’s life expectancy factor, according to the table below, is 25.5. His IRA balances as of December 31, 2023, were $100,000. To calculate his RMD, Allen will need to divide his balance of $100,000 by 25.5. The minimum that Allen needs to withdraw is $3,921.57.

Effective January 1, 2022, the IRS updated the Uniform Lifetime Table with longer distribution periods to reflect longer life expectancy, which will spread your withdrawals over a longer period (see table below for a comparison of the old and new life expectancies). Longer distribution periods mean that each year’s RMD may be smaller than it would have been previously.

The table above is a partial table that reflects ages 72-90. The full IRS Uniform Lifetime Table stops at 120.

If you have more than one qualified retirement account, you must determine a separate RMD for each account. You do not have to take an RMD out of each account…you can total the RMDs and take the total from one (or more) of the accounts.

4. Be careful of waiting until November or December to take your RMD.

People often wait until the end of the year to take their RMDs, which can lead to potential issues. First, if the stock market is down in November or December, you’ll end up selling investments in a down market. Another potential problem is that as you get busy with the holidays, you might forget to take your RMD and may be faced with a penalty on the amount you failed to withdraw. There is not a “right way” or “wrong way” to plan your distributions.

5. Make sure you work with a financial advisor who has expertise in retirement planning.

Calculating your RMDs can be confusing, especially if you have several accounts. In addition, everyone’s RMD situation and financial needs are different. Working with a financial advisor is essential to achieving your financial goals and can help you figure out the best way to take your RMDs and maximize your accounts as part of an overall retirement plan.

Source: https://www.fidelity.com/learning-center/personal-finance/secure-act-2