Tax-loss harvesting is a way of lowering your tax burden when buying and selling securities in your portfolio. It uses the money you lose on one investment to offset the profit you make on another. In today’s volatile markets, tax-loss harvesting can offer you a way to make good use of some capital losses you may have experienced. It might let you take some profit on other investments – without having to pay some or all of the tax that action would otherwise trigger.

It could also let you sell securities in one sector that is “overweight” in your portfolio because the sector is overperforming – and offset the gains with losses elsewhere to minimize the taxes due.

Ultimately, the strategy can lower or eliminate capital gain taxes or reduce your ordinary taxable income. But it can’t be applied to retirement accounts like your 401(k)s or IRAs because losses in tax-deferred accounts can’t be deducted.

Let’s look at when tax-loss harvesting can apply.

When can you apply the tax-loss harvesting strategy?

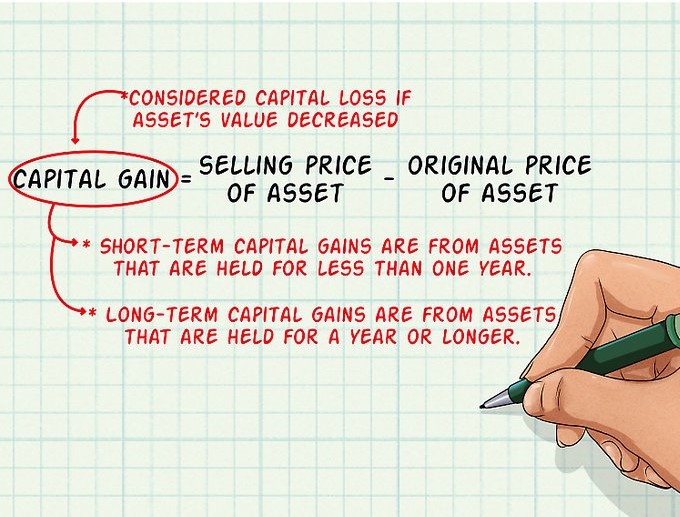

When you sell a security (i.e., mutual fund or ETF) for more than you paid for it (so, at a profit), you generate a capital gain. You’d have to pay tax on that gain if the security was held in a taxable brokerage account.

But what if you sold the security for less than what you paid for it? You’d incur a capital loss.

Those gains and losses only trigger a taxable event when you complete the purchase or sale of a security. But you can examine your portfolio and find unrealized gains and losses by simply looking at each security’s current value and comparing it with your purchase price.

Let’s look at a few examples:

Say you invested in two funds several years ago, placing $6,500 in each. Fund #1 has dropped in value to $4,750, while Fund #2 is now worth $8,250. You have a capital loss on Fund #1 and a capital gain on Fund #2 of equal size — $1,750 – so one offsets the other. If you were to sell them both, you would have no capital gains taxes to pay.

But what if you didn’t have perfect offsets, and if those same funds – with $6,500 in each originally – had different results? Fund #1 is now worth $8,000, and Fund #2 has dropped to $2,000. Your capital gain of $1,500 and capital loss of $4,500 would give you a net loss of $3,000. If you sold them both within the same tax year, your tax exposure on the gain would be wiped out, but you would still have a net loss of $3,000.

You still have a benefit, even if you have no other capital gains to put against your remaining loss. You can apply up to $3,000 per year to offset your regular taxable income, and if your loss exceeds $3,000, you can carry the remaining loss forward to apply to future years. However, if you are married and file separate tax returns, you will have to share the maximum applicable $3,000 net loss; you can each only reduce your regular income by $1,500.

Are there any pitfalls to watch out for?

Yes, one of which is the IRS’s “wash sale” rule. You can’t claim the loss on the sale of an investment if the same – or “substantially identical” – investment is bought either 30 days before or after the sale date.

Another pitfall is overlooking the consequences of state taxes, if you live in a state that taxes capital gains. To do so could negate your reasons for applying the tax-loss harvesting strategy.

How are taxes calculated on net capital gains?

Tax-loss harvesting reflects buying and selling activity throughout the tax year, and you may find you sell securities you have held for differing periods. If you have held a security for more than one year, your capital gain or loss is considered long-term. For one year or less, you have a short-term capital gain or loss (you count from the day after you bought the asset up to and including the day you sold it).

As the end of the year approaches, you want to separate long- and short-term gains and losses. Long-term losses are applied to long-term gains, and short-term losses to short-term gains. Only then can an excess loss in one category be applied to gains of the other.

You’ll want to monitor both because short-term capital gains are taxed at your ordinary income tax rate of up to 37% for 2022, depending on your federal income tax bracket. Long-term capital gains, however, are taxed at lower rates – at 0%, 15%, or 20%, based on your annual taxable income.

You ultimately will pay taxes on your net capital gain for the year. You start by calculating your net long-term capital gain for the year. To do that, you subtract your long-term capital losses (plus any unused, leftover long-term capital losses from previous years) from your long-term capital gains. Then you subtract your net short-term capital loss for the year from your net long-term capital gain for the year. That gives you your net capital gain.

Net long-term capital gain = long-term capital gain minus long-term capital loss

Net capital gain = net long-term capital gain minus net short-term capital loss

Your goal is to be left with no short-term gains, which are taxed at your ordinary income’s tax rate. But if you end up with a net capital gain for the year after buying and selling different combinations of long- and short-term securities, you can access the lower rates applied to capital gains. You may even decide to hold off on the sale of a security until you have held it for a year to avoid being left with short-term gains.

How else can tax-loss harvesting benefit you?

Besides offering you the opportunity to lower your tax burden, tax-loss harvesting can help you adjust your portfolio to meet your investment needs and asset-allocation strategy. To do so, you may sell an investment that is underperforming and losing money, and you use the loss to reduce your taxes. Then you use the proceeds to invest in a different, more appropriate security. Or you may decide to repurchase the asset after the 30-day window, especially if it has fallen further, but you believe it has long-term upside potential. The options are endless.

Wrapping up

Most people think of tax-loss harvesting as a year-end activity to lower your exposure to capital gains taxes or to intentionally generate a loss to reduce your income tax liability by up to $3,000. Instead, it can be a year-round strategy that keeps you mindful of the ups and downs of your investments and lets you maximize your after-tax investment outcomes without year-end pressures.

But the strategy is not without its complexities. To be sure that this powerful strategy is being applied as effectively as possible – while avoiding any pitfalls – it’s important to get input from a trusted financial advisor.

At Capital Advantage, we are always looking for ways to help you reduce your tax bill. Tax-loss harvesting is one of the tax-saving strategies that we employ annually.