Without getting into the weeds of Prop 19, here are 3 main takeaways:

1. The biggest winners are California homeowners aged 55 and older.

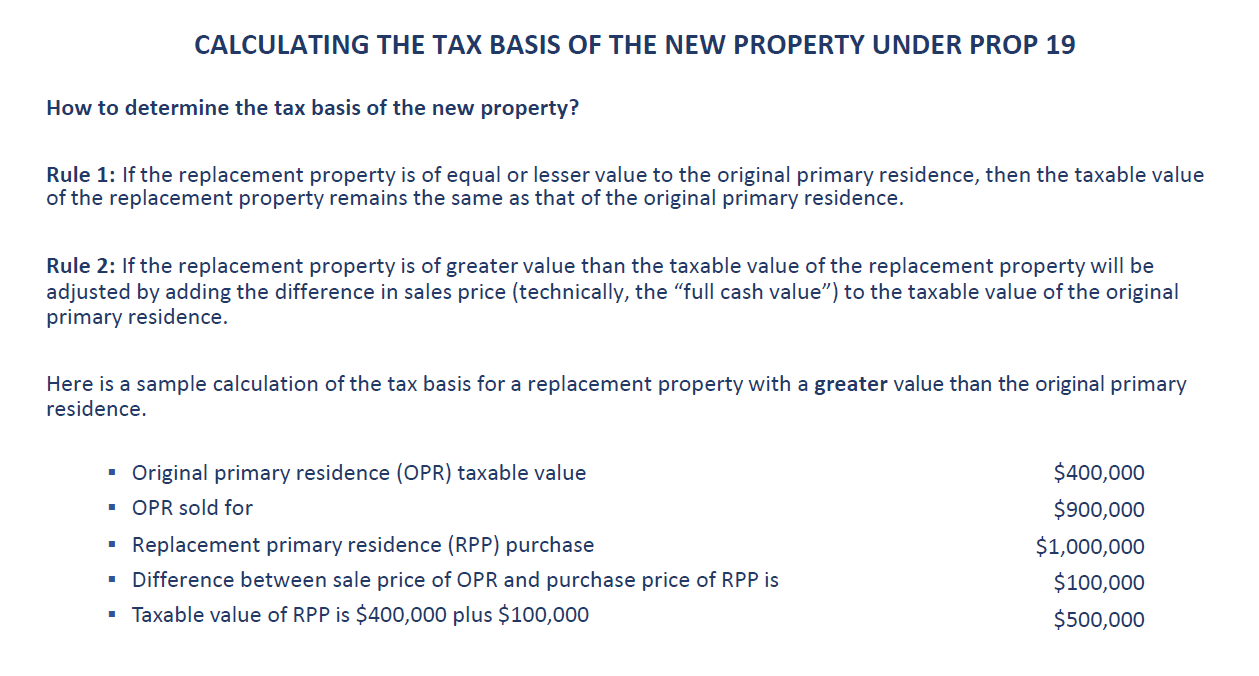

Qualified homeowners may now move anywhere in California and transfer their current tax basis (taxable value of their primary residence) regardless of the value of the new primary residence—even if the new residence is greater in value.

Previously, Prop 13 limited tax basis transfer to within the same county (or to one of 10 counties that accepts intercounty tax basis transfers) and only to a replacement property of equal or lesser value.

2. Homeowners have more opportunities to move to a new residence without a hike in property taxes.

Eligible homeowners can now transfer the assessed tax value of their primary residence up to three times. This is good news for older homeowners, as it gives them more flexibility to downsize, move closer to family, or find a home that better fits their needs as they age.

Previously, homeowners had only one opportunity to transfer their original tax base to a new home.

3. The biggest losers are (non-spouse) family members.

Prop 19 is essentially a tax hike for family members that are going to receive a property via a family transfer, intra-family sale, or inheritance. Property tax values will now be reassessed when a family member takes ownership.

Previously, family members were exempt from reassessment and able to retain the low property tax basis.

As noted, I did not delve into the details of Prop 19. Capital Advantage does not provide tax, legal or accounting advice. If you need assistance with understanding how the new Prop 19 rules affect your unique situation, please consult your tax advisor.