First, let’s review short-term vs long-term capital gains, then I’ll discuss how to sell appreciated assets without paying federal income tax.

Please note that Capital Advantage is neither an attorney nor an accountant, and no portion of this article content should be interpreted as legal, accounting or tax advice.

Short-term vs long-term capital gains

When an investor sells an investment for more than what they bought it for, they realize a capital gain. There are two types of capital gains–short-term and long-term. If the investment is held for less than one year, the profit from the sale is considered a short-term capital gain and is taxed at the investor’s ordinary income tax rate. On the other hand, if the investment is held for more than one year, the profit from the sale is treated as a long-term capital gain, which is subject to a maximum 23.8% tax rate. For example, if you bought Amazon stock at $2,000 in January 2020 and sold it for $3,000 in March 2021 you would have realized a long-term capital gain of $1,000.

Harvesting Capital Gains at 0% Long-Term Rates

The simple description of harvesting gains is to strategically turn unrealized long-term gains into realized gains while you’re in a more favorable tax position.

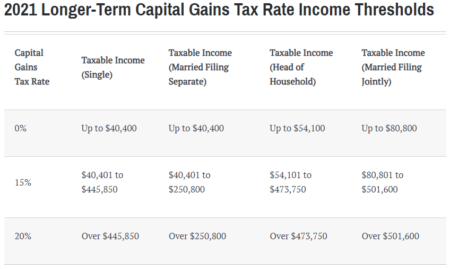

The most straightforward way to avoid paying taxes on long-term gains is to realize gains in a year when you fall within the income brackets that are taxed at 0%. If you’re married filing jointly, that applies if your taxable annual income is $80,800 or less. For single filers, the threshold is $40,400 (see chart below).

The income thresholds for the capital gains tax rates are adjusted each year for inflation

Source: Kiplinger.com

A low-income year and the opportunity to take advantage of the 0% rate could occur in a number of situations. For instance, temporary unemployment, commission-based jobs where income varies from year to year, and during retirement, you could create a low-income year by choosing which accounts to take withdrawals from.

Here’s an example of how this might work. If you are married filing jointly and your taxable income (after subtracting itemized deductions or the standard deduction) is $60,000. You still have room for $20,800 before you reach the $80,800 threshold. Here’s where you could plan for approximately $20,000 of realized gains and pay 0% federal income tax on them.2

If you fall into the 0% tax bracket, escaping capital gains tax isn’t a done deal. Keep in mind that the gain on the sale of your assets counts towards the $40,400/$80,800 taxable income limit. There are also some caveats for state taxes. For instance, California doesn’t recognize different tax rates for realized long-term gains, and state income tax would still be due after realizing gains. Additionally, capital gains are still considered when determining how Social Security benefits are taxed.

Positioning Your Portfolio to Avoid Capital Gains Taxes

There are numerous strategies for positioning your portfolio properly to minimize and in certain cases, even avoid capital gains taxes. Your financial advisor can help you determine what your tax impact might be this year and help you design a course of action that is consistent with your overall financial plan.

Capital Advantage works closely with tax professionals to help design and execute strategies like the one discussed above. Contact us if you’d like to discuss how we can apply this strategy to your portfolio or to learn more about Capital Advantage.

- www.irs.gov/statistics/soi-tax-stats-irs-data-book

- www.thebalance.com/how-to-use-the-zero-percent-tax-rate-on-capital-gains