Positives

- U.S. unemployment rate remains low at 4.1% in July

- U.S. GDP declined 0.5% in March

- U.S. inflation at 2.7% CPI trailing year in June

- U.S. growth artificial intelligence sector still rallying

Risks and Concerns

- U.S. government policies likely to be inflationary

- U.S. imposed tariffs on international trade could slow global GDP growth & potentially cause a recession

- Tariffs currently causing market uncertainty & volatility

The Quarter in Review

Foreign and domestic equity markets recovered in the second quarter after a painful start that was mainly fueled by the U.S. government’s announcement of significant trade tariffs upon most foreign trade partners. Year-to-date through the end of the quarter, the S&P 500 U.S. large cap stock index has returned 6.2% and the Bloomberg U.S. Aggregate Bond Index has returned 4.02%. The following chart details index performance, and it’s notable that total bond market performance is not far behind stocks with dramatically less volatility. Foreign stocks have significantly outperformed U.S. stocks so far this year; this is mostly attributable to the U.S. dollar falling 10.7% on concerns over government debt and deficit spending, which led Moody’s to downgrade the credit rating of the U.S.

The most recent measure of U.S. GDP in March showed a 0.5% decline from the fourth quarter of 2024; this decline was distorted by a large spike in imports as suppliers attempted to build inventories ahead of trade tariffs going into effect. Unfortunately, if second quarter GDP also comes in negative, the U.S. will meet the historical definition of a recession (2 quarters of GDP contraction in a row). This is a real possibility given the increase in the cost of goods due to tariffs, the decline in U.S. government spending, and the elimination of many government jobs.

Current Investment Strategy

After several risk reduction efforts in the first quarter (selling some U.S. small and mid-cap equities), we made another risk reduction move in the second quarter, shifting approximately 2-3% U.S. large cap blend equity to U.S. large cap value equity.

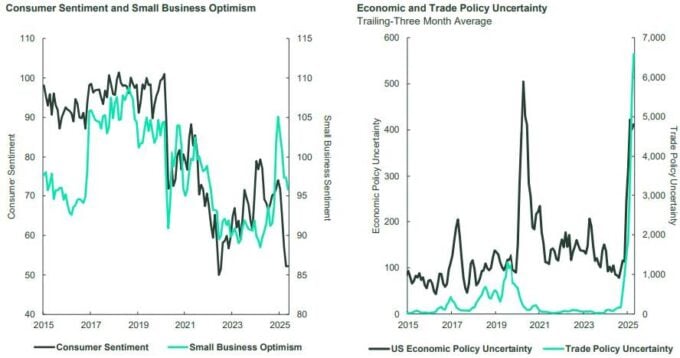

We have no further risk reduction efforts planned right now, but we remain concerned about how increased uncertainty has led to increasing embedded risk in equity markets. The following charts illustrate how uncertainty over U.S. trade policy has spiked in 2025 while both consumer sentiment and small business optimism have declined.

Trade policy uncertainty has resulted in a difficult decision-making environment for most businesses, resulting in delays in hiring and budgeting decisions. Likewise, consumers are retrenching their spending with the on-again / off-again tariffs causing uncertainty in the future price of goods. This opaque economic outlook has led us to pause further strategy changes as we wait to assess further developments.

Future Asset Allocation Changes and Considerations

Uncertainty has been mentioned several times in this communication and is our main concern for the latter half of this year. The risk of trade wars remains high, as the deadline for much higher U.S. tariffs going into effect has now been moved to August 1st. While tariffs may be delayed again, it seems likely that higher prices on many imported goods should be expected. This functions as a regressive tax on U.S. consumers that most effects those with the lowest income, which will decrease consumer spending, slow the economy, and increase recession risk. Furthermore, tariffs that increase the cost of goods are inflationary; this was measured in the June CPI inflation reading which increased 0.3% to 2.7% in the trailing year. The Fed’s preferred measure of core inflation increased to 2.9%, well above their target of 2.0%. This makes it less likely that the Fed will cut interest rates soon and places further upward pressure on these rates. Higher interest rates lead to higher mortgage rates (which are currently stalling the U.S. housing market). In summary, the current uncertain conditions do not lead to an optimistic outlook for the U.S. economy in the second half of 2025.

The following table shows the results of a State Street Global Advisors survey of investors which asked them to rank what they see as the top risks to investment portfolios in 2025, and the results are much as we expect (and have already been summarized). Trade wars and tariffs, increased chance of recession, inflation, volatility, and uncertain U.S. government policy top the list.

Despite a rather bleak outlook, we have identified several opportunities in response to the current situation. First, higher interest rates are not necessarily negative for investors, as there are opportunities to shift allocations to cash and short-term bonds and collect high interest rates with much lower risk (relative to equities). This is a shift we have already made from U.S. mid and small cap equity in the first quarter of this year.

Next, there may now be greater investment opportunities in equities abroad, mainly in the E.U. and Asia. International equity diversification has been effective this year for the first time in several, as the U.S. dollar declined and foreign investments were able to hedge this decline. The E.U. equivalent of the U.S. federal funds rate is currently 2.0%, much lower than the federal funds rate (currently 4.25% – 4.50%), and therefore more stimulative to economic growth. We are considering a possible shift from U.S. equity to international, and should market risks elevate further, may also consider a further risk reduction move from U.S. equity to cash or short-term bonds.

Key Investment Takeaways

- We aimed to decrease risk once again this quarter, moving some U.S. large cap blend equity to value

- The U.S. has enacted tariffs on global trade that have increased recession risk

- Inflation remains above the Fed’s target and with unemployment low, the Fed is unlikely to cut rates

- International equity has outperformed U.S. equity overall, mainly due to a weakening U.S. dollar

We will continue to monitor the market risks of this rapidly changing and volatile environment, frequently adjusting as needed with the goal of protecting and growing your investment portfolio. As always, please feel free to contact us with any questions or concerns.

Your Capital Advantage Team