The 5 years leading up to retirement through the first 5 years after retirement is the most crucial period that a retiree will go through – in fact, a successful retirement (i.e. not running out of money) may boil down to this 10 year period known as “the Fragile Decade.”

So why do these 10 years need to be handled with such care?

During market volatility, an important and potentially devastating risk a retiree faces is called sequence-of-returns risk; or the risk of combining withdrawals with poor portfolio returns. This combination can simply deplete a retiree’s portfolio too quickly.

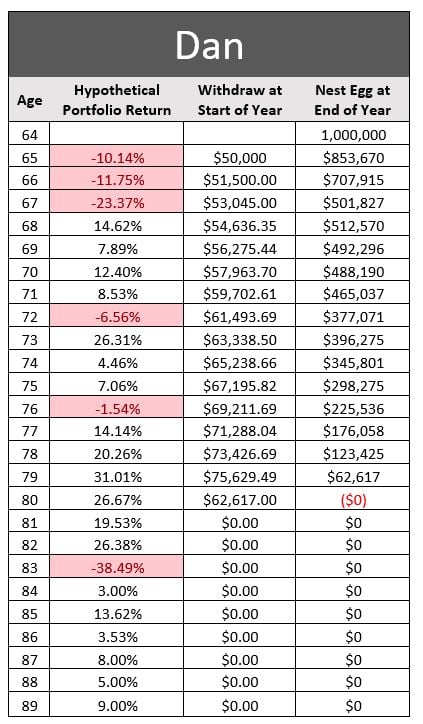

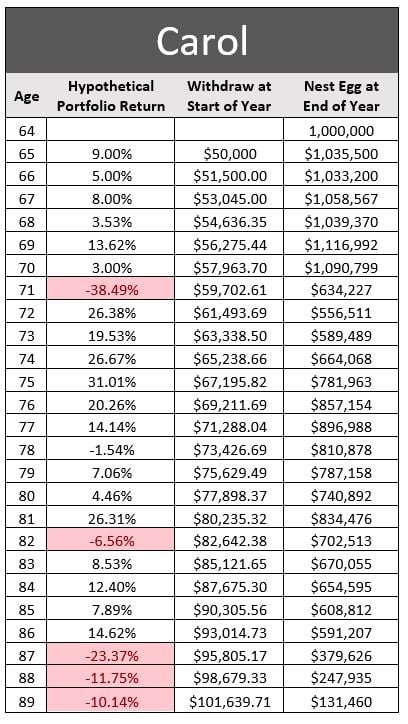

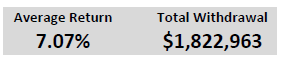

In retirement, sequence-of-returns can matter more than the average return of the portfolio. For example, let’s look at Dan and Carol, two people with the same starting balance of $1 million, with the same average return of 7.07%, and the same withdrawal strategy but with two totally different retirement outcomes.

Dan, 65 years old, has accumulated $1,000,000 and is ready to retire. He plans to take 5% ($50,000) distributions from his portfolio each year. Dan has also determined that he will increase his portfolio withdrawals by 3% a year to keep pace with the cost of living (inflation).

Unfortunately, during Dan’s fragile decade, his portfolio experiences some losses in the first three years of retirement (see chart below).

After withdrawing $990,000 over a 15-year period, Dan runs out of money at the age of 80.

Carol, age 65 has also accumulated $1,000,000 and is ready to retire. And like Dan, has chosen to distribute 5% of her portfolio; plus take an annual 3% increase in portfolio withdrawals to keep up with the cost of living (see chart below).

Conversely, Carol withdraws $1,800,000 over a 24-year period and still has money at the age of 89.

Why the disparity? The only difference was the sequence in which the returns were achieved (in this case the order of returns were simply reversed).

Portfolio withdrawals compounded with losses, make it more difficult to recover from a portfolio decline, especially during the fragile decade.

Navigating the fragile decade is difficult and can be challenging, even for experienced investors. It’s a time in your life when even temporary market volatility can increase the likelihood of running out of money during retirement.

What can you do?

To best prepare for the risks faced during your fragile decade:

- Understand the risks in your portfolio; use historical volatility and return numbers on similar portfolios to see what might happen during your fragile decade.

- Build-in flexibility; be prepared to reduce your portfolio distributions during bad years, but feel free to increase your distributions during good years.

- Be mindful of your tax liabilities; use a strategy that allows you to minimize taxes throughout retirement.

- Know how much you can withdraw before you retire; understand what level of annual distributions your portfolio can likely sustain for the duration of your retirement.

Too many people focus on getting to retirement, but not through it. It’s important to plan.

If you aren’t sure where to begin, schedule a meeting with one of our expert advisors at Capital Advantage, Inc. Contact us today to begin a free retirement assessment.